Mortgage Process

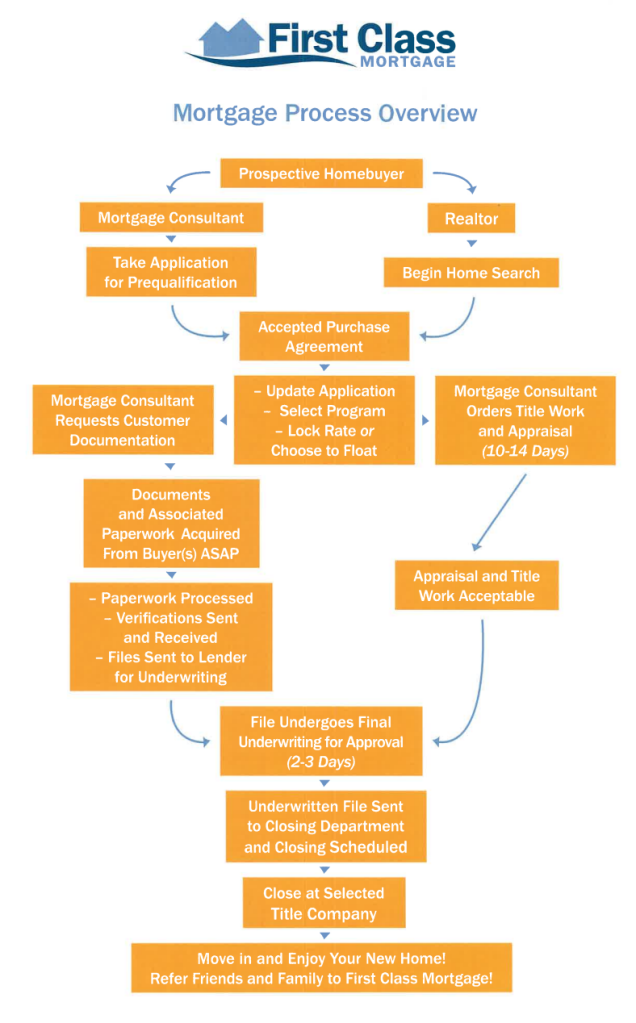

From the borrower's perspective, the mortgage process can be broken down into 3 main phases. Below, are the 3 phases at a glimpse. There are obviously more things within it, but this will give you a general idea of how they work. If you would like to learn more I’d love to chat!

Application

The beginning of the process, the application is the gathering of all your information to see what you can qualify for. This includes how much you make, how much you have to put down and much more. We may ask for some documentation, during this step if needed but for the most part none is needed to get you a prequalification letter and begin shopping!

Processing

Processing begins once you have a signed purchase agreement on your new home! During this step we will ask for all of your documentation to close the mortgage. Depending on your type of mortgage the amount of documentation will vary. But almost every mortgage requires 30 Days Paystubs, 60 days Bank Statements, Last 2 years W2’s and your drivers license. If you would like to get ahead of the curve you can begin gathering that information before hand! Once we have all the required documentation, we will handle the rest!

Closing

This is the part you have been waiting for! During closing you would go to your preference of title company and sign all of the closing documents. Depending on if it is a refinance or a purchase, you would either get the keys to your new home and celebrate! Or celebrate your better terms on your new mortgage!

Below is a flow chart of our process if you are interested in learning a bit more!